Financial reporting and planning are the backbone of strategic business decisions. Yet, despite their importance, the tools we use, mainly spreadsheets, are outdated, error-prone and inefficient. It’s time to rethink the way we manage financial information.

Where does traditional planning fall short?

Spreadsheets like Excel have been the go-to solution for decades. But they were never designed to be the central tool for enterprise-level financial planning. Here’s why:

- High Error Rates

92% of users reported having problems using spreadsheets while planning their financial reports. And even 88% of spreadsheets contain errors. That’s not a typo. These range from simple typos to flawed formulas that quietly cascade through forecasts and budgets.

- Manual, Time-Consuming Work

Using spreadsheets for financial reports often involves tracking down the “latest version”, manually updating assumptions, re-validating numbers after each change and even copy-pasting between files. All this work is time consuming and inefficient.

It’s not uncommon for finance teams to spend 60–70% of their time just compiling data rather than analysing it.

- Version Chaos and Data Fragmentation

A small correction in one spreadsheet often leads to the creation of a new version. This results in multiple inconsistent files, not knowing which version is the last and correct as well as having no trackability of who changed what, giving company chaos as their data is fragmented.

- Data Is Always Outdated

Because data is pulled manually and reports are static, insights are instantly outdated. By the time a monthly report is distributed, the numbers may already be irrelevant to current decisions.

- No Traceability or Collaboration

While many modern spreadsheets offer co-authoring, this usually works only in their online versions, where core functionalities are limited or performance drops on larger files. Version tracking, commenting, and change transparency remain basic compared to dedicated planning tools, making it hard to understand who changed what and why.

- Not Built for Big Data

Spreadsheets struggle when handling large datasets. As file sizes grow, calculations slow down, links break, and collaboration becomes unreliable. Even with cloud versions, performance degrades once you move beyond a few hundred thousand rows or multiple linked sheets. They were never designed for modern data volumes, making them unsuitable as a foundation for scalable planning or analytics.

What are Excel alternatives for planning?

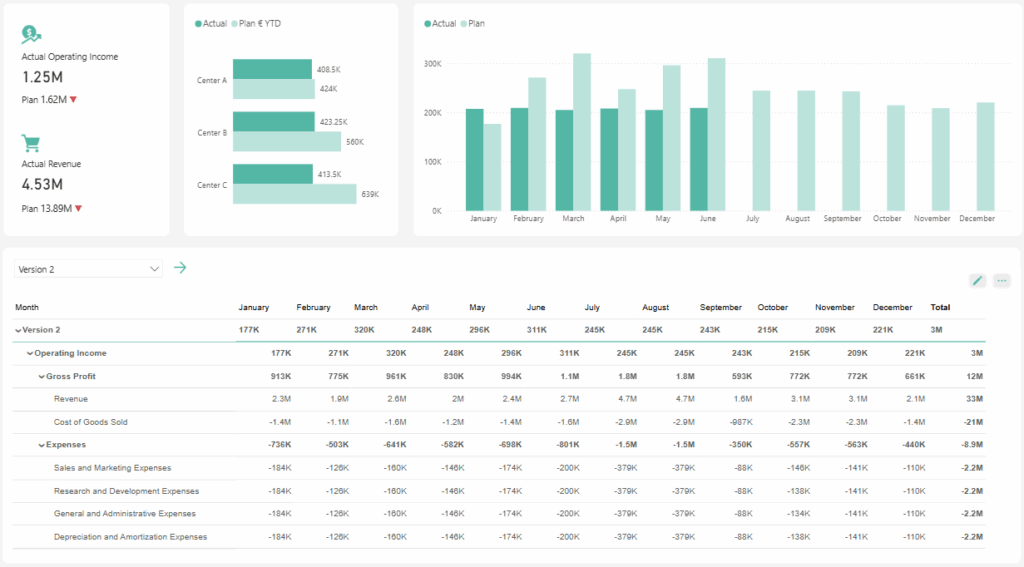

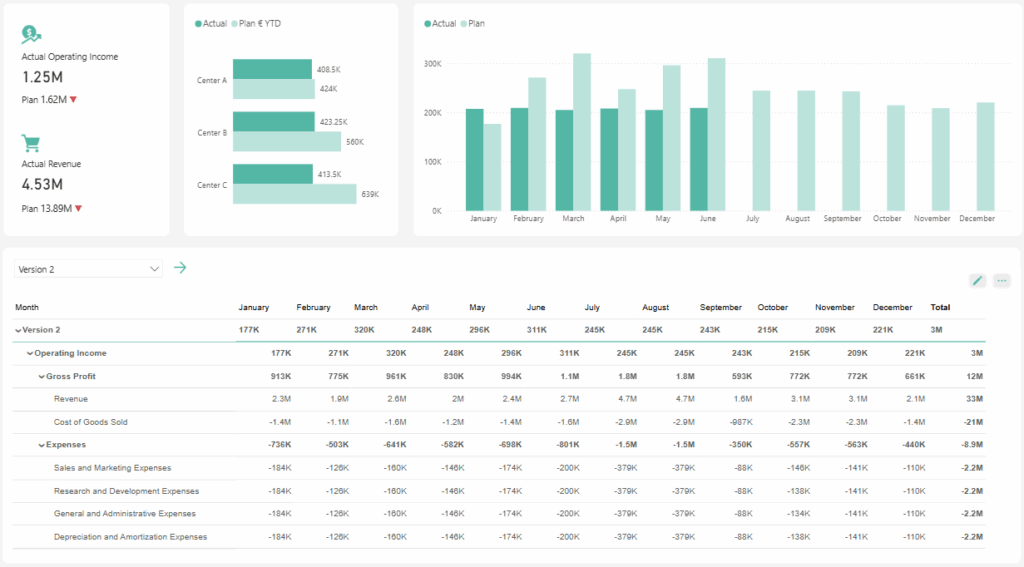

We believe that financial reporting and analytics should be done within a single tool and not scattered through external tools. Here is how we simplify traditional planning using a Power BI writeback visual WeWrite.

- One data source

WeWrite connects directly to your data sources (from Microsoft SQL, Azure SQL, MySQL, Snowflake, PostgreSQL, Databricks and even Microsoft Fabric). Because it’s a Power BI writeback add-on, any changes made in Power BI are instantly reflected in your database. Version control ensures that your data stays current, consistent, and aligned across planning and reporting.

- No Errors (Reduction)

Our platform automatically validates calculations and when you adjust a total field, the child positions automatically update. This significantly reduces the risk of errors that go unnoticed in traditional spreadsheets.

- Collaboration (comments) with full Traceability

WeWrite enbles teams to add comments (row and cell level, drill-through) directly where it’s necessary. This drastically improves user experiences as you plan on your existing data, enhances workflows, improves collaboration and increases transparency. Every change is tracked, timestamped, and reversible. No more guessing who edited what or when.

- Built-In Version Control

With WeWrite, versioning becomes part of your planning process – not an afterthought. You can create, duplicate, or compare plan versions directly within Power BI, without exporting files or overwriting existing data. Each version is stored in your database, ensuring full auditability and consistency across teams. This makes it easy to track changes over time, run “what-if” scenarios, and keep everyone aligned on the latest numbers.

- Save time and gain insights

WeWrite eliminates repetitive manual tasks so finance teams can focus on what really matters: understanding the numbers, analysing trends, making and efficient smart operational decisions.

- No more dependency on external tools

We built WeWrite for the purpose of financial teams having it all in one place, from planning to analytics and understanding trends behind it all. That means no more relying on clunky formulas, patchwork files or external tools.

Are you ready to start making more efficient financial decisions? Try free demo!